As a transformative event in the world of payments, Money20/20 USA has long been a stage for innovation, connection, and insight. This year, B4B Payments continued its tradition of attending and contributing to the event, bringing our thought leaders to engage in critical industry conversations. Here’s a look at how our team experienced and participated in this year’s show.

Lori Breitzke’s Journey with Money20/20

Lori Breitzke, our Head of Channel Development and Strategy, has a history with Money20/20 that stretches back to its initial run in 2012. As a seasoned expert in the fintech industry, Lori Breitzke highlights the event’s growth and maturation over the years. She recalls her initial encounters with Money20/20, describing it as a transformative experience in a time when fintech was still finding its footing.

“Back then, it was all about discovering new possibilities and building connections in a rapidly evolving space. “Today, it’s inspiring to see how much deeper the conversations have become, with even more opportunities for collaboration and growth. The show has matured yet remains a hub of innovation and partnership.” Lori Breitzke, Head of Channel Development and Strategy.

For Lori, Money20/20 continues to inspire. It’s not only a place for trendsetting but also a meeting ground for building enduring partnerships and exploring long-term strategies. As she noted, this year’s show provided both emerging trends and established frameworks, proving that Money20/20 remains as dynamic as ever.

Jodie Taylor’s Marketing Perspective

Jodie Taylor, Head of Marketing (EU/UK) at B4B, has attended Money20/20 for the past five years, bringing a valuable marketing perspective to the event. Her experience has consistently centred on how Money20/20 provides an exceptional platform to gain industry insights, explore new marketing opportunities, and connect with fellow industry leaders. Like Lori, Jodie sees Money20/20 as a place where lasting connections are formed and forward-looking marketing strategies come to life.

Money20/20 was as incredible as ever, but this year held something truly special. I had the privilege of joining an engaging panel discussion at our booth with Betsy Samuel, CMO of Thredd, and Araminta Robertson, Managing Director of Mint Studios and founder of The Fintech Marketing Hub CIC. Together, we explored the intricacies of fintech marketing in the EU/UK versus the U.S., sharing actionable strategies and fresh ideas for fintech brands aiming to connect meaningfully with audiences on both sides of the Atlantic. Jodie Taylor, Head of Marketing (EU/UK)

B4B Payments’ Contributions at Money20/20 2024

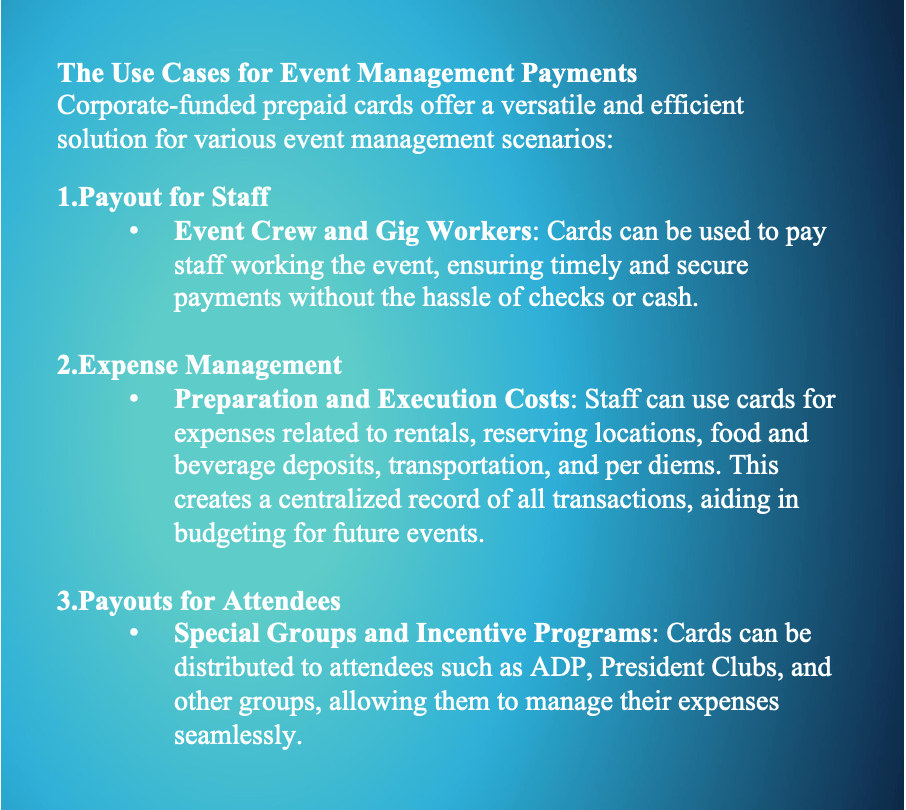

This year, B4B Payments took part in various activities aimed at showcasing our platform’s value and engaging in timely industry conversations. Our team presented a live demo, spotlighting B4B’s innovative approach to prepaid and expense management solutions. This hands-on demonstration showed attendees how our platform empowers businesses with real-time expense tracking, rapid fund distribution, and flexible, multi-currency capabilities.

We were also proud to be part of two impactful panel discussions. Lori Brietzke joined Dayo Okewale, Senior Advisor in the House of Lords (UK government), to discuss the significance of diversity in fintech leadership. They explored the critical role of inclusive financial services in shaping a more equitable and accessible industry. The conversation highlighted that while fintech is often seen as a hub of innovation and forward-thinking, the industry still struggles with fully understanding some of the markets it serves and unlocking real opportunities to innovate and drive meaningful change. Getting diversity, equity, and inclusion (DEI) right is about more than just ethics; it’s about results.

The 2019 analysis report by McKinsey & Company on Diversity wins: How inclusion matters, companies in the top quartile for gender diversity on executive teams were 25 percent more likely to achieve above-average profitability compared to those in the fourth quartile, an increase from 21 percent in 2017 and 15 percent in 2014

Additionally, Jodie Taylor shared the stage with Betsy Samuel, CMO at Thredd, to delve into the differences between fintech marketing strategies in the UK and the US. This conversation highlighted the unique approaches and challenges in reaching audiences on both sides of the Atlantic.

Solving Industry Challenges: B4B Payments Featured in FinTech Magazine

In FinTech Magazine’s November issue, B4B Payments USA CEO Kieran Draper shared insights during Money 20/20 USA, focusing on Driving fintech innovation with streamlined payment processes and advanced tech, the US market expansion strategies for scalable growth and Shaping the future of payments with tailored solutions for industry demands. This feature highlights B4B Payments’ commitment to solving industry challenges and driving innovation. Watch the live interview.

Addressing Industry Challenges: B4B Payments’ Brian Lawlor in The FinTech Times

At Money20/20 USA 2024, B4B Payments’ Group CCO, Brian Lawlor, shared insights with The FinTech Times on addressing industry pain points; addressing Embedded Finance as a Game-Changer for seamless integration of financial services to tackle inefficiencies and drive growth across industries. Through these advancements, B4B Payments is directly responding to industry demands for greater efficiency, transparency, and scalability. Watch the full interview here

As we look back on another successful year at Money20/20, we’re reminded of the power of collaboration and innovation in driving the fintech industry forward. If you’re interested in learning more about B4B Payments’ solutions or would like to connect. We’d love to discuss how we can support your business goals.