Travel and tourism are rebounding in the U.S. and abroad, and digital payments are being used to support renewed growth, offer added value, and streamline payments to vendors and suppliers

Around 1.4 billion tourists traveled internationally in the first nine months of 2024, as the global tourism sector recovered 98% of pre-pandemic levels. The U.S. tourism industry continues to experience remarkable growth within that recovery, reaching a record-breaking $2.36 trillion. This upward trend reflects not only the resilience of the sector but also the increasing demand for seamless and convenient travel experiences.

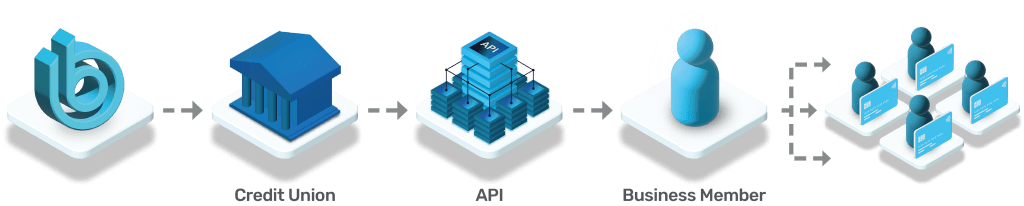

Modern travelers and tour operators increasingly value digital solutions that enhance convenience, security, and efficiency. As a result, digital payments, including prepaid cards and digital wallets, are pivotal in supporting the industry’s continued expansion. Businesses operating in tourism must adapt to this shift by integrating flexible payment solutions to remain competitive and improve customer and vendor experiences.

Evolving Travel Trends and Digital Payments

The nature of travel is evolving. Today’s travelers, particularly younger demographics and high-income professionals are taking longer trips, seeking premium accommodations, and blending work with leisure. These travelers rely heavily on digital transactions, preferring secure and budget-friendly payment methods like prepaid cards.

Enhancing the Travel Experience with Prepaid Cards

With the continued increase in travel costs due to rising fuel prices and inflation, travelers are more conscious of budgeting than ever before. Businesses can provide added value by offering prepaid cards, which empower travelers to manage their spending effectively.

Using B4B Payments’ prepaid travel cards and mobile applications, travelers can:

- Instantly load and track funds

- Monitor real-time transactions and upload receipts

- Add physical or virtual cards to mobile wallets for seamless payments

Additionally, prepaid cards eliminate the inconvenience of carrying cash. Should a card be lost or stolen, users can quickly deactivate it and transfer funds to a new virtual or physical card, ensuring a hassle-free experience. Businesses can also deploy prepaid cards for specific scenarios, such as emergency assistance for stranded passengers, rapid funding for tour guides, or as part of a customer loyalty program.

Streamlining Vendor and Supplier Payments

Beyond enhancing traveler convenience, prepaid cards and digital payments significantly benefit travel and tourism businesses in managing supplier and vendor relationships. Prompt and reliable payments strengthen partnerships, improving service quality and customer satisfaction.

B4B Payments offer businesses a streamlined alternative to traditional banking methods such as wire transfers, checks, and cash. Our prepaid card solutions allow travel and tourism businesses to:

Simplify Expense Management

- Equip your teams with secure virtual and physical prepaid cards for seamless, on-the-go payments covering everything from rentals and reservations to food, transportation, and beyond.

- Pay commissioned sales associates faster and more efficiently.

Transact in Local Currencies

- Rapidly issue USD, EUR, or GBP cards to match your travel and tour needs.

- Minimize high FX fees, ATM costs, and international transaction charges.

Centralized Control, Real-Time Insights

- Manage everything from a single, user-friendly platform.

- Features include receipt capture, automated card loads, auto top-ups, and detailed expense tracking.

- Streamline reconciliation.

Furthermore, companies can leverage digital payments to incentivize vendor loyalty through channel incentive programs and rewards, fostering stronger relationships that support business growth.

As the travel and tourism industry continues upward, businesses must embrace digital transformation to meet evolving traveler expectations. Prepaid cards and digital payments present an opportunity to enhance tour and travel experiences while optimizing business operations. By adopting B4B Payments’ secure and flexible prepaid solutions, travel companies can stay ahead in a competitive landscape, ensuring their customers and service providers benefit from streamlined, efficient, and secure payment methods.

To find out more about how B4B works with travel and tourism companies, get in touch with us.

References: